SASE Market to Grow over 500% by 2025? Yes, It Could Happen!

A new report by 650 Group estimates that by 2025 the Secure Access Service Edge (SASE) market will grow five-fold to reach over $11 billion. The report identifies Zscaler, Hewlett Packard Enterprise (HPE), Cisco, Fortinet, and Versa Networks as the five market leaders in this high growth segment.

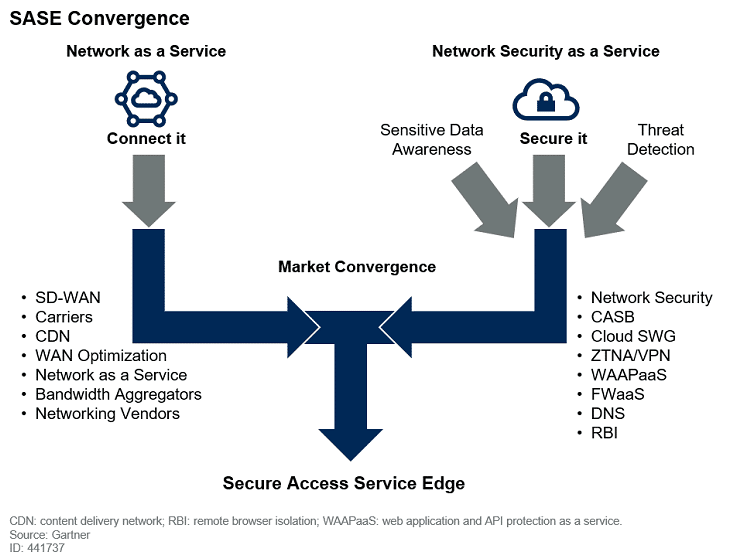

First introduced in the 2019 Gartner report The Future of Network Security Is in the Cloud, SASE is a conceptual model for delivering integrated wide-area networking (WAN) and cybersecurity as a cloud service.

SASE is a paradigm that has generated high interest among enterprises, security and networking vendors, and investors. And as 650 Group notes, it is driving industry consolidation as networking and security vendors merge or acquire their way towards a complete SASE offering. At Enea, we have certainly witnessed this first-hand through the M&A activity of our own customers. There are also three other points of alignment between 650 Group’s analysis and what we are observing on the ground as a provider of embedded traffic intelligence software.

1) We Are Seeing Industry Convergence Unfold in Real-Time

The 650 Group report states that SASE is driving convergence between the networking and security industries. We are seeing this too, but with the telco industry in the mix as well. Enea’s traffic inspection engine, Qosmos ixEngine®, is embedded in a wide variety of enterprise networking, telecom networking and cybersecurity products, giving us a broad, first-hand view of this convergence.

For a long time, each of the vendors embedding our DPI engine primarily served one of these three distinct markets and sold to a distinct group of end customers: enterprises, telecom operators / ISPs, or managed service providers. With use cases like SD-WAN and SASE, the borders are disappearing. In fact, the border crossings are becoming so frequent that we have begun a shift from industry-based to solution-based marketing. How do you categorize a vendor typically in a telco market who is developing a SASE offer for enterprise customers? Where do you present SASE use case information when use cases have traditionally been slotted as telco, networking or security?

2) SD-WAN, FWaaS, SWG & CASB are High Growth Use Cases, and SASE is the Likely Driver

650 Group identifies five core SASE functions, of which a vendor needed four to be included in the report. These core functions are SD-WAN, secure web gateway (SWG), zero trust network access (ZTNA), cloud access security broker (CASB), and firewall-as-a-service (FWaaS). We do not track ZTNA as a separate market segment because it is typically integrated into higher functions like CASB. But, certainly the other four are among the high growth use cases for us, and we do believe an evolution toward SASE is the driver. In addition, there has been a significant increase in the number of vendors asking us about embedding Qosmos ixEngine in what they are explicitly labelling a SASE solution.

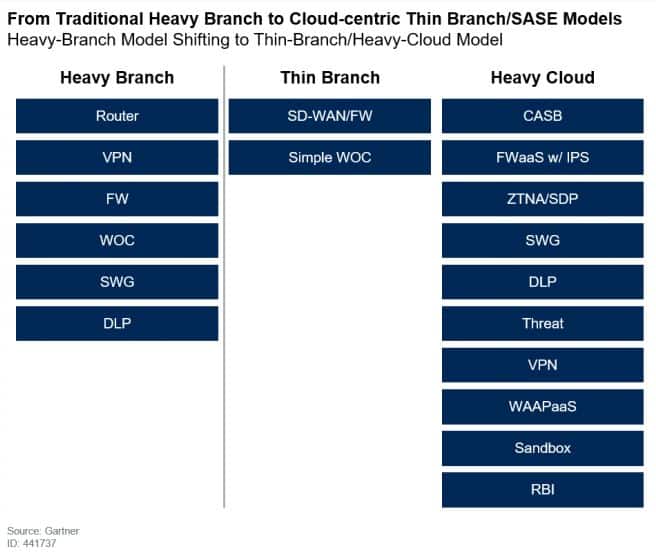

3) A Pragmatic Path Toward SASE

Another interesting aspect of the 650 Group report is that they did not exclude vendors who were using partnerships to deliver SASE services. In our business, we are seeing customers in such partnerships delivering real SASE benefits to their customers today. And, we have observed that all are taking a pragmatic, evolutionary approach to SASE. Whether they are incumbents filling gaps in SASE functionality through M&A, internal development or partnerships, or they are pure-play SASE start-ups, nearly all deployments are hybrid to one degree or another. They are designed to respect the investments in on-premise networking and security that companies have made, and to support special customer requirements for on-premise capabilities for specific edge locations, such as the need for a continued dedicated link between two locations, or the need for heavy branch functionality at certain critical locations.

The trend toward thin branches is happening, but thick branches in certain locations will persist for a very long time.

Further reading

To learn more, you will find the 650 Group press release announcing the report here:

SDxCentral also wrote a news article about the report:

And, to learn more about how SASE vendors are using Qosmos ixEngine in their products, visit our SASE web page, and see our blog post about an important new feature for SD-WAN and SASE, First Packet Advantage.