How are Italian and Spanish Mobile Operators Managing the Coronavirus Crisis?

Network operators around the world have been thrown headfirst into crisis mode. They must ensure that their networks can handle the unprecedented demand created by people around the world working from home. Add to that the additional network capacity needed for millions of students to complete schoolwork online, a surge in gaming, streaming and other bandwidth-intensive activities that skyrocketed, and the world’s network operators have experienced the penultimate “Make it work” moment.

The question now is: How are they doing? The answer: A really impressive job.

Managing your network in a crisis – lessons from Europe

To learn more about how COVID-19 and the world’s response to it are impacting operator networks, join Enea Openwave for a special Microcast on Wednesday, April 8. ABI Research and Strategy Analytics discuss how operators in Italy and Spain are managing their networks during this unprecedented crisis. Register on MOVIC (Mobile Video Council) website

The quick 15-minute special microcast will focus on data from the two most affected western nations for both fixed and mobile networks, what the world can expect based on that data and what operators should be doing to prepare.

The Microcast panel will discuss some of the news headlines from around the world that show the impact that COVID-19 has had on network operators:

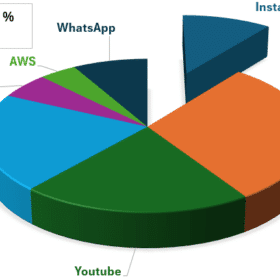

- In Italy, WhatsApp has had a 20% year-on-year increase in the number of messages and calls

- Also in Italy, Microsoft has seen 100% growth in usage of enterprise productivity application Teams

- Telefonica’s Movistar, Orange, Vodafone, Masmovil and Euskaltel in Spain say that IP network traffic has increased 40%, while mobile has increased 50% for voice and 25% for data.

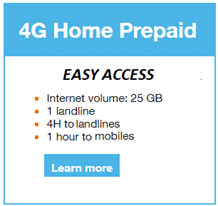

- Operators have been remarkably generous to their customers throughout the crisis. AT&T waived fees for going over data caps and provided internet data to limited-income households for $10 per month. T-Mobile and Sprint are providing unlimited data on all mobile plans for 3 months, as well as 20GB of mobile hotspot service during that time. Telefonica Spain is increasing mobile plans by an additional 30GB per month for two months, as well as providing extra content to TV packages.

The numbers that Enea Openwave is tracking for operators is no less impressive:

- Vodafone Italy has seen a peak traffic throughput of 90%+, while average throughput has increased by 80%

- Italy has seen an increase of 40% in Xbox live and Netmarble.com

- South America is seeing peak traffic and average throughput each increased by 29%

- Congested traffic in India has increased by 25%

- In Southeast Asia, peak traffic has increased by 38%, while their average throughput has increased by 12%

- Roaming partners like Vivo Brazil & Syniverse are seeing a significant drop in traffic volumes due to global travel restrictions

Some questions the Microcast panel will look to answer include:

- What lessons can other operators learn?

- What do global mobile data trends reveal?

- Can mobile internet connectivity be shared equally without bandwidth throttling?

- How can mobile operators prepare for post-crisis recovery?

What struggles remain ahead?

Without question, operators are facing challenges now and will continue to do so for months. One of the most important points to consider is that even as operators meet these challenges, the increases in data that traverse their network during the crisis will not correlate to increases in revenue. Indeed, operators are likely to suffer a loss in roaming revenues.

Meanwhile, numerous mobile operators are struggling to keep networks up and running, while others are experiencing downtime due to stress. Some operators are asking customers to use landlines whenever possible to take pressure off of wireless networks.

Netflix and YouTube have reduced streaming quality in Europe for at least the next month to prevent the internet from collapsing under the strain of unprecedented usage. Netflix say this will reduce Netflix traffic on European networks by around 25%.

And then there are the negative impacts of the pandemic on 5G:

- COVID-19 is likely to delay the 3GPP Release 16 and will slow the progress of full deployments for 5G SA use cases

- China is aiming to continue its 5G deployments, despite the challenges presented by COVID-19

- COVID-19 will disrupt 5G commercial launches in several countries